Colorado Senior Property Tax Exemption Weld County . senior property tax exemption. a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. As property owners are reviewing the impact of property valuations on. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. For those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. Published on may 23, 2023. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or. Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption available.

from www.exemptform.com

for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. senior property tax exemption. Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption available. a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. For those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. As property owners are reviewing the impact of property valuations on. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or. Published on may 23, 2023. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star.

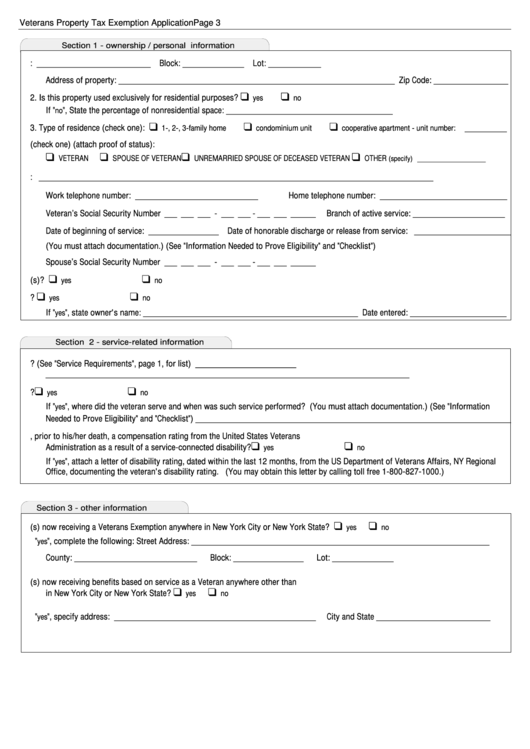

Tax Exemption Form For Veterans

Colorado Senior Property Tax Exemption Weld County the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. Published on may 23, 2023. As property owners are reviewing the impact of property valuations on. a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. senior property tax exemption available. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or. For those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption.

From www.countyforms.com

Tarrant County Property Tax Exemption Forms Colorado Senior Property Tax Exemption Weld County senior property tax exemption. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or. As property owners are reviewing the impact of property. Colorado Senior Property Tax Exemption Weld County.

From www.rodneyjstrange.com

County Legislature Increases Senior Citizen Tax Exemption Rodney J Colorado Senior Property Tax Exemption Weld County a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. senior property tax exemption. As property owners are reviewing the impact of property valuations on. Often referred to as the senior homestead exemption, qualifying individuals receive a. Published on may 23, 2023. For those who qualify, 50 percent of the. Colorado Senior Property Tax Exemption Weld County.

From northfortynews.com

2020 Colorado Senior Property Tax Exemption Funded Colorado Senior Property Tax Exemption Weld County a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. For those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. senior property tax exemption. for those who qualify, 50 percent of the first $200,000 of actual value of the property is. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Form Ptax 340 Senior Citizens Assessment Freeze Homestead Exemption Colorado Senior Property Tax Exemption Weld County a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption available. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. on january 1. Colorado Senior Property Tax Exemption Weld County.

From forms.utpaqp.edu.pe

How To Fill Out Harris County Homestead Exemption Form Form example Colorado Senior Property Tax Exemption Weld County senior property tax exemption. Published on may 23, 2023. senior property tax exemption available. As property owners are reviewing the impact of property valuations on. Often referred to as the senior homestead exemption, qualifying individuals receive a. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. a. Colorado Senior Property Tax Exemption Weld County.

From www.pdffiller.com

2019 Form MO Personal Property Tax Waiver Application Jefferson Colorado Senior Property Tax Exemption Weld County senior property tax exemption. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. Published on may 23, 2023. As property owners are reviewing the impact of property valuations on. For. Colorado Senior Property Tax Exemption Weld County.

From www.dochub.com

Colorado department revenue Fill out & sign online DocHub Colorado Senior Property Tax Exemption Weld County the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or. For those who qualify, 50 percent of the first $200,000 of actual value of. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Fillable Form Dte 23 Application For Real Property Tax Exemption And Colorado Senior Property Tax Exemption Weld County senior property tax exemption available. Published on may 23, 2023. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those who do not qualify for the senior or. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. For those who. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Form Ptax340 Application And Affidavit For Senior Citizens Colorado Senior Property Tax Exemption Weld County the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. As property owners are reviewing the impact of property valuations on. Published on may 23, 2023. senior property tax exemption available. Often referred to as the senior homestead exemption, qualifying individuals receive a. For those who qualify, 50 percent. Colorado Senior Property Tax Exemption Weld County.

From www.weld.gov

Property Tax Exemptions Weld County Colorado Senior Property Tax Exemption Weld County Published on may 23, 2023. As property owners are reviewing the impact of property valuations on. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. For those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. for those who qualify, 50. Colorado Senior Property Tax Exemption Weld County.

From reeblaural.pages.dev

Ohio Homestead Exemption 2024 Form Lexis Lillis Colorado Senior Property Tax Exemption Weld County Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption available. a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. senior property tax exemption. on january 1 st 2023, the state of colorado is expanding the deferral program to allow those. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 Colorado Senior Property Tax Exemption Weld County the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. Often referred to as the senior homestead exemption, qualifying individuals receive a. senior property tax exemption. As property owners are reviewing the impact of property valuations on. For those who qualify, 50 percent of the first $200,000 of actual. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Senior Citizen Property Tax Exemption Application Form printable pdf Colorado Senior Property Tax Exemption Weld County a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. senior property tax exemption available. senior property tax exemption. As property owners are reviewing the impact of property valuations. Colorado Senior Property Tax Exemption Weld County.

From assessor.elpasoco.com

Appeals Process & Notice of Valuation El Paso County Assessor Colorado Senior Property Tax Exemption Weld County a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. As property owners are reviewing the impact of property valuations on. on january 1 st 2023, the state of colorado. Colorado Senior Property Tax Exemption Weld County.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County Colorado Senior Property Tax Exemption Weld County for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. senior property tax exemption. senior property tax exemption available. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. on january 1 st 2023, the state of colorado. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons Colorado Senior Property Tax Exemption Weld County senior property tax exemption available. For those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. Often referred to as the senior homestead exemption, qualifying individuals receive a. a property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously. As property owners are reviewing. Colorado Senior Property Tax Exemption Weld County.

From gussiqsallie.pages.dev

Colorado Senior Property Tax Exemption 2024 Esther Karalee Colorado Senior Property Tax Exemption Weld County Often referred to as the senior homestead exemption, qualifying individuals receive a. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. on january 1 st 2023, the state of. Colorado Senior Property Tax Exemption Weld County.

From www.formsbank.com

Application For Homestead Property Tax Exemption Form printable pdf Colorado Senior Property Tax Exemption Weld County the property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as gold star. senior property tax exemption available. for those who qualify, 50 percent of the first $200,000 of actual value of the property is exempted. For those who qualify, 50 percent of the first $200,000 of actual value of the. Colorado Senior Property Tax Exemption Weld County.